Ever wondered if your favourite video company has ever tried to evade taxes? Well, if it’s a big corporation, there’s a good chance it has. A Dutch journalist called Jesse Frederik has written an incredible piece about how American companies use foreign countries to avoid paying taxes, and how the Netherlands has become a popular tax haven for these companies. Video game makers, as it turns out, are no different.

Take Activision Blizzard for example, as Jesse mentions it in his article. It is a titan of the video game industry, known for bestselling franchises like Call of Duty and World of Warcraft. And as one would think, these games are technically made in America as the company that makes these games is located in America. Here’s the kicker, though. On paper, these games are made in a basement in Rotterdam, the headquarters of ATVI CV. In 2009, Activision Blizzard transferred the ownership of its games to ATVI CV, which has as a result been able to make a profit of € 2.9 billion between 2009 and 2014. These are profits on which Activision had to pay a staggering tax of zero dollars. What’s more interesting is that this company has NO employees and its management resides in Bermuda. Also, can anyone remember seeing ATVI CV when you load up an Activision Blizzard game? It would only be logical for the company that owns these games to at least get their logo on the game screen.

How is this made possible, you ask? Thanks to the conflicting taxation laws in the two countries, of course. A CV is the Dutch equivalent of a “Limited Partnership”, or an LP. The Dutch government sees this CV as responsible for paying taxes in the US, while the US government says that the CV should pay taxes in the Netherlands. As a result, the company pays taxes to neither. Jesse Frederik calls it a ‘fiscal no man’s land’ and aptly compares it to the rabbit/duck picture. For those who don’t know, it’s a famous illustration which can be perceived either as the image of a rabbit or a duck, depending on the observer.

Now one might say that a company with no employees earning in billions is taking things a bit too far. And they would be completely right. So, ATVI CV in turn has a BV (A limited liability partnership or LLP) that is in-charge of handling Activision’s international sales. Here’s how it works (Image Source)

To get a better understanding of how these video games evade taxes, you can watch this video by Super Bunnyhop which explains it really well.

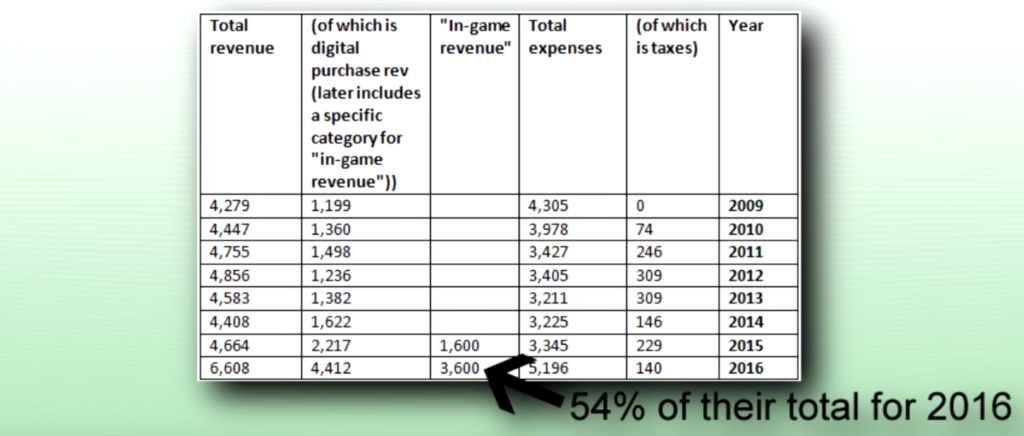

As the video explains with precise figures, the amount that Activision has been spending in taxes keeps on decreasing by the year, though their profits are sky-high. And the methods employed by them are completely legal. Now, if you’re wondering why a country would have laws that enables these companies to evade taxes, this might help: Alexander Hent, Senior Director for International Tax at Activision is actually a member of the Tax Committe in the American Chamber of Commerce (or AmCham) in the Netherlands, which essentially means that it is a part of his job to lobby for such laws.

Alright, so taxes are going down. Profits are going high. But are these costs savings actually helping the players, or better, Activision’s own employees? The answer seems to be a big fat no. If you remember, earlier this year Activision laid off a number of employees. The company has been consistently reducing production costs, trying to hoard and maximize profits. Here’s a screenshot from the above video, showing revenue numbers. Note how the revenue is increasing but taxes have been going down. Also note that 54% of the total revenue is from in-game purchases. Or as you may better know it, micro-transactions. That’s right. Players are paying more for in-game purchases than they are for the actual games, which are quite expensive to begin with.

Activision isn’t the only culprit when it comes to tax evasion. Take any number of big American companies, and you’ll discover they’re all using foreign nations as tax havens, and unfortunately, these practices are considered well above board.

Activision isn’t the only culprit when it comes to tax evasion. Take any number of big American companies, and you’ll discover they’re all using foreign nations as tax havens, and unfortunately, these practices are considered well above board.

Register with us for the best in gaming, and join us for video game discussions on our forums.