Monetisation is at an exceptionally beginning stage in India’s $1.5-billion Mobile Gaming Industry yet it shows the possibility to reach $5 billion by 2025, as indicated by a new report.

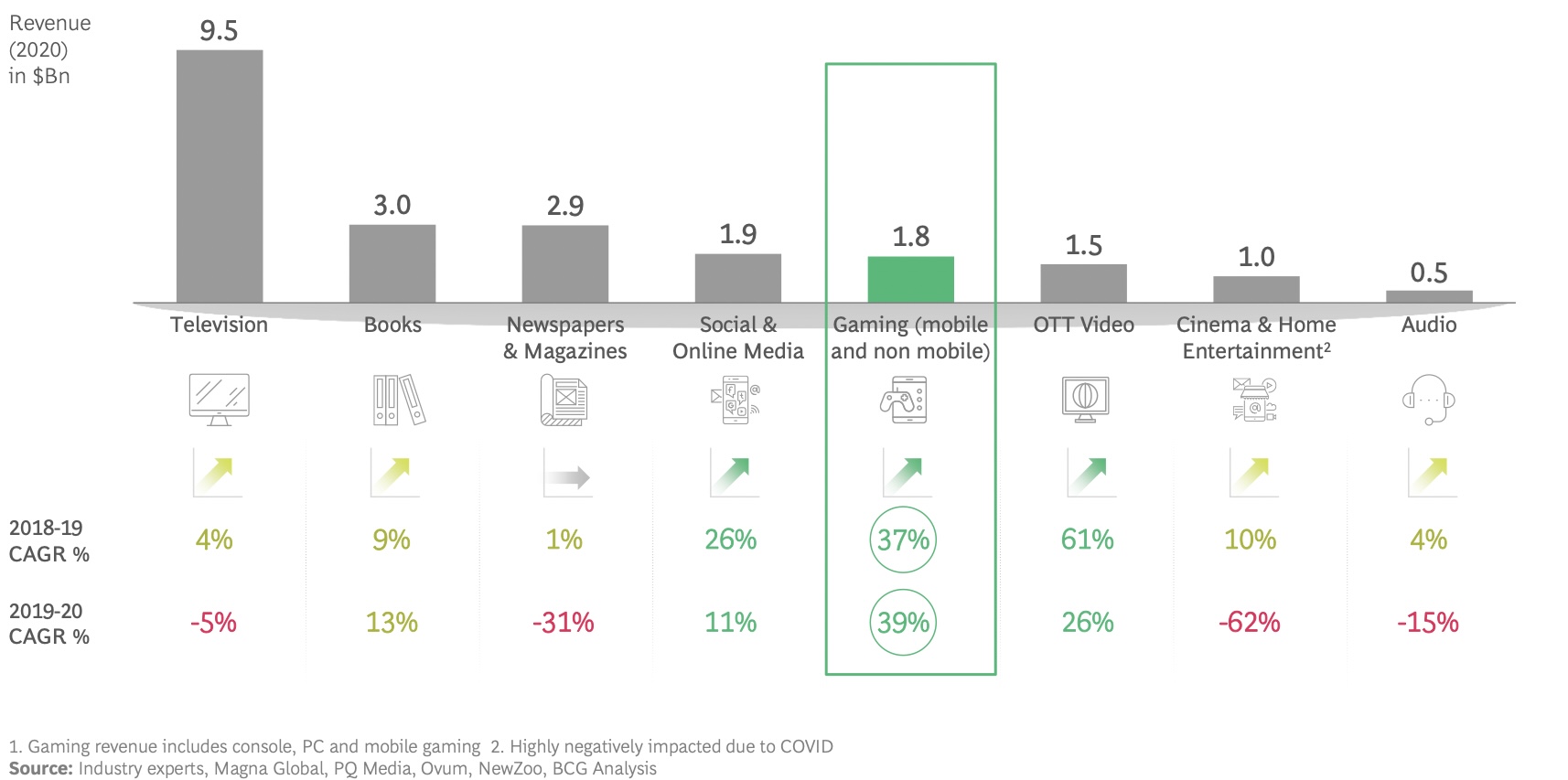

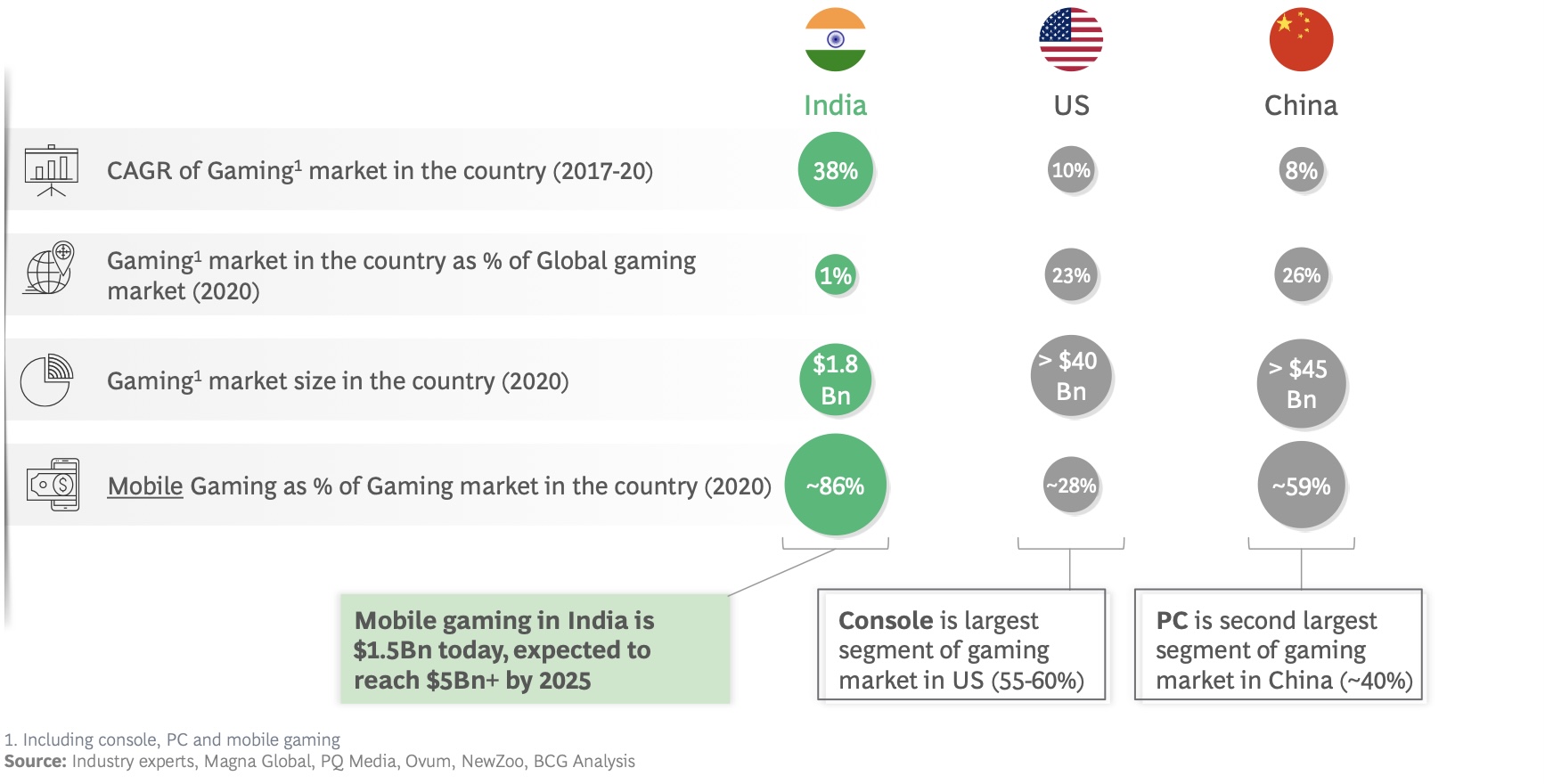

The gaming area in India is becoming quicker than most media sub-areas — including film and home amusement, sound and that’s just the beginning. Albeit the Indian gaming industry is right now more modest than that of the US and China and is 1% of the worldwide gaming market, it is, notwithstanding, producing $1.5B income and expected to significantly increase to $5B+ by 2025 on the rear of the “portable first” peculiarity. Gaming in India has been catalyzed by better cell phones, expanded web access, famous titles, powerhouses, and the worldwide pandemic.

“The gaming business in India has seen a development of practically 40% in 2019-20, more than that of OTT, TV and online media stages. 86% of this market comprises of cell phone clients. While there is enormous reliance on promotion incomes today, expanding foothold and commitment is relied upon to drive higher ability to pay which will drive better approaches for client adaptation and rising ARPUs before very long”, said BCG Managing Director and Senior Partner, Vikash Jain.

Gaming in India smaller than US, China but growing rapidly on the back of “mobile first” phenomenon

A normal Mobile gamer in India burned through $3-10 out of 2020, when contrasted with $57-66 spent by a mobile gamer in China and $73-77 by a gamer in the United States, said the report by Sequoia India and the Boston Consulting Group. This does exclude genuine cash gaming (RMG) spends and was adapted to buying power equality for 2020.

The report noticed that there is a huge development opportunity in the area in India, since just 46% of Indians were associated with the web in 2020, as against 60% in China and 89 percent in the US. Likewise, just 22% of the populace has played somewhere around one versatile game starting at 2020, contrasted and 45 percent in China and 52 percent in the US.To jump further into this space, Sequoia India banded together with BCG to evaluate the current portable gaming market in India, and its possibilities for development in a report named ‘Versatile Gaming: $5B+ Market Opportunity.

This chance is likewise drawing in financial backers to the area. India’s gaming area has packed away $549 million subsidizing in the main quarter of 2021 – up from $412 million out of 2020 and $175 million of every 2019.With a 39 percent accumulate yearly development rate (CAGR) in FY20, the gaming area is becoming quicker than most media sub-areas in India, incorporating online media with 11% CAGR and video web based with 26% CAGR.

The report likewise features how India is arising as both a venture opportunity and an ability center point for the world. Discussing financial backer opinion, Rajan Anandan, Managing Director, Sequoia India said, “Monetisationof Indian games, which has been a worry before, is now at $1.8B incomes sloping quickly. The business is seeing a critical financial backer interest in Indian gaming. Truth be told, 33% of all the subsidizing for gaming in India came in the main quarter of 2021. The ascent of gaming stages is particularly invigorating, as confirmed by 80% of all subsidizing going to stages.”

Gaming in India has been catalyzed by better smartphones, increased internet access, popular titles, influencers, and COVID

“The Indian gamer isn’t characterized by their segment. They are fairly characterized by their unique circumstance – their necessities, inclinations, and gaming propensities. A normal player who plays to keep away from fatigue might go through around 1-2 hours on games, while a stalwart gamer who plays for the cutthroat soul, can invest almost twofold the energy on gaming while at the same time playing a similar game or an alternate game all together. Organisations that can comprehend these changed buyers and distinguish which ones are they truly serving are the ones which will lead the market”, said the report.

For the partners, the report features key goals that will drive the following influx of development for this high speed industry. These incorporate upgrading the revelation and reception through easygoing and allowed to mess around, further developing utilization and maintenance by enhancing sorts to expand commitment and maintenance, and viably driving adaptation through limited estimating procedures, among others. MPL, for instance, has a sort skeptic stage. This has prompted them being famous with a more extensive assortment of gamers, bringing about more paying clients and higher maintenance than most others in the space.

“80%+ of the versatile gaming market is driven by client spends, i.e., in-application buys and genuine cash games, further catalyzed by wide accessibility of value cell phones, reasonable web and UPI,” said Prachi Pawar, Associate, Sequoia India.At long last, the report additionally digs profound into the essential decisions of the absolute best versatile gaming organizations in India — Nazara, MPL, Dream11 and Gameskraft. “Being the main movers in their particular fragments, a portion of these organizations have helped shape the Indian gaming market. They keep on wagering on new development openings and construct upper hand to remain ahead in this high-stakes game,” said BCG Principal, Wamika Mimani.

Openings in this always developing gaming industry are huge in India. New stories are arising each day, and many accept the best is on the way.